The Biggest Corporate Scams of the Last 25 Years: Who Survived, Who Collapsed, and Who Thrived?

Key Takeaways

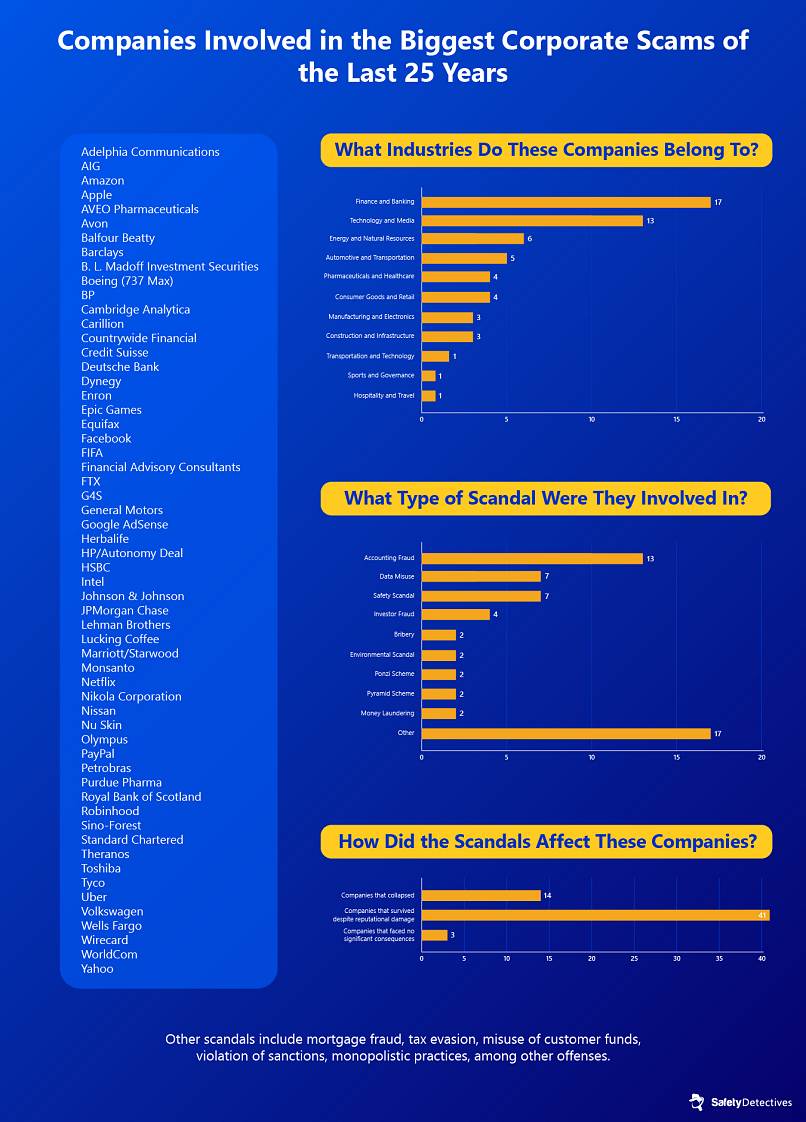

- Over a quarter (29.3%) of the companies involved in big corporate scandals belong to the Finance and Banking sector.

- Only 14 of the 58 companies analyzed shut down because of the scandals they were involved in.

- The majority of the analyzed companies (70.7%) faced some reputational and financial damage but continued operations after the scandal.

- 85% of the publicly traded companies that continued operations had their lowest stock price as a direct result of the scandal coming to light.

- PayPal, Google AdSense, and JPMorgan Chase seemingly faced no significant repercussions for their unethical actions, continuing to make large profits when the scandals broke out.

Over the past 25 years, some of the world’s biggest companies have been brought down by scandals involving fraud, corruption, and unethical practices. While some companies collapsed under the weight of the scandals, others managed to survive by paying fines or reforming their practices.

We decided to explore the most notorious corporate scams of the last two decades, examining who fell, who endured, and who managed to profit despite their wrongdoing.

Who Collapsed? Scandals That Ended Companies

For this study, we analyzed 58 companies to see what went wrong and how bad the fallout was. Let’s start with the worst outcome — shutdowns. Of all the companies we looked into, only 14 shut down after the scandals they were involved in.

Some of these companies we already mentioned above — Adelphia Communications, Bernard L. Madoff Investment Securities, Carillion, Enron, Theranos, and Worldcom — so let’s go over the other 8 companies that collapsed after the scandals.

Lehman Brothers

The collapse of Lehman Brothers was mainly due to its heavy investment in risky mortgage-backed securities tied to the subprime housing market. As the housing bubble burst, these securities lost value, which caused significant financial strain. Lehman filed for bankruptcy on September 15, 2008, making it the largest bankruptcy in U.S. history to date (over $600 billion in assets).

Cambridge Analytica

Cambridge Analytica, a British political consulting firm, misused personal data from up to 87 million Facebook users, collected without consent via a personality quiz app. The data was used to create psychological profiles and target voters during political campaigns.

These practices were first revealed in 2018 and sparked global outrage, regulatory investigations, and lawsuits against both Cambridge Analytica and Facebook. The company filed for bankruptcy and ceased operations in May 2018.

FTX

FTX was a major cryptocurrency exchange that went bankrupt in November 2022 after allegations that founder Sam Bankman-Fried misused customer funds, funneling billions to Alameda Research for speculative trading while concealing an $8 billion deficit. Unable to fulfill obligations, FTX filed for bankruptcy on November 11, 2022, with over 100 affiliated entities.

Sino-Forest

Sino-Forest was a Canadian-listed forestry company that defrauded investors by overstating its timber assets and revenue. A 2011 report by Muddy Waters Research labeled the company a Ponzi scheme, causing a collapse in its stock value and regulatory investigations. The company filed for bankruptcy in 2012 with $2.4 billion in liabilities, leaving shareholders with massive losses.

Wirecard

Wirecard was a German payment processor and financial services provider accused of fabricating revenues and inflating its balance sheet to hide financial losses. In June 2020, Wirecard admitted that roughly a quarter of its assets (over $2 billion) likely never existed, sparking investigations.

Financial Advisory Consultants

Financial Advisory Consultants founder, James P. Lewis, ran a Ponzi scheme that defrauded investors out of approximately $300 million. The scheme collapsed in 2004 when authorities uncovered the fraud, leading to Lewis’ arrest and conviction.

Nikola Corporation

In 2020, Nikola Corporation was accused of misrepresenting the capabilities of its hydrogen-electric trucks, leading to a $125 million SEC settlement and a fraud conviction for the company’s founder (though he was granted a full pardon in early 2025). Still, the scandal brought the company canceled partnerships and financial struggles, ultimately filing for Chapter 11 bankruptcy in February 2025.

Countrywide Financial

Countrywide Financial’s subprime mortgage scandal involved the company’s reckless issuance of high-risk loans, often through deceptive practices and lax underwriting standards. This misled investors and homeowners, contributing to the 2008 financial crisis and resulting in significant legal and financial repercussions for the company. No longer able to keep operating, it was acquired by Bank of America in 2008.

Below, you can see the stock prices of some of these companies before and after the scandals mentioned above came to light.

Who Recovered? Companies That Survived Major Scandals

Despite suffering reputational damage, the vast majority (41 of the 58 analyzed companies) managed to overcome the scandal they were involved in and continue operations.

Here are some of the ones we found most interesting.

Boeing (737 Max)

Following two fatal Boeing 737 Max crashes in 2018 and 2019 — resulting in the deaths of 346 people — Boeing faced criticism for its handling of safety concerns and transparency issues, culminating in a $487.2 million fine. The company continues to operate today, but the scandal caused decreased sales, canceled orders, and a loss of market share to competitors like Airbus.

Epic Games

In 2022, Epic Games faced a $520 million FTC settlement for violating the Children’s Online Privacy Protection Act by collecting data from children under 13 without parental consent. Additionally, the company used “dark patterns” in Fortnite to trick players into unintended purchases, including locking accounts of users disputing charges.

Equifax

The Equifax data breach of 2017 exposed sensitive personal information of 147.9 million Americans, including Social Security numbers, birth dates, and addresses, due to unpatched software vulnerabilities. The breach led to a $700 million settlement with regulators. Public trust in Equifax plummeted, with its “Buzz” score dropping from 0 to -33 just 10 days after the incident.

Beyond the 2018 Cambridge Analytica incident, Facebook has faced numerous data privacy scandals over the years, including the exposure of 533 million users’ data in 2021 and misuse of two-factor authentication numbers for targeted advertising. These scandals have left lasting reputational challenges and stock price declines, with losses exceeding $134 billion in market value at their peak.

FIFA

In one of the most significant corruption cases in sports history, FIFA was accused of widespread bribery, racketeering, and money laundering related to the awarding of World Cup 2018 and 2022 hosting rights to Russia and Qatar. The scandal implicated top FIFA officials in a decades-long scheme involving $150 million in bribes.

G4S

In 2013, G4S faced a major scandal when it was revealed that the company had been overcharging the UK government for electronic tagging services, billing for individuals who were either dead, in prison, or otherwise not being monitored. The Serious Fraud Office launched an investigation, and G4S eventually agreed to repay £109 million.

General Motors

In 2014, General Motors recalled nearly 30 million vehicles worldwide due to defective ignition switches that could unexpectedly shut off engines, disable airbags, and cause crashes. GM had known about the issue for over a decade but delayed action, leading to at least 124 deaths. After the scandal came to light, the company faced intense scrutiny and paid $900 million in penalties.

HSBC

In 2012, HSBC was fined $1.92 billion after U.S. authorities found it laundered over $881 million for Mexican and Colombian drug cartels. Despite this, HSBC continues to operate today, having implemented substantial reforms to its compliance systems and anti-money laundering protocols.

Intel

In 2001, Intel (the largest semiconductor manufacturing company in the U.S.) was accused of pressuring computer manufacturers into exclusive agreements, limiting competition from rival chipmakers like AMD. The controversy led to legal challenges in multiple regions, including a record $1.45 billion fine by the European Commission in 2009.

Johnson & Johnson

In a scandal spanning decades, U.S. pharmaceutical company Johnson & Johnson has been accused of selling talc-based products — including baby powder — that contain asbestos, a known carcinogen. The company stopped selling talc-based powders in North America in 2020 and globally in 2023. Recent settlements include a $700 million agreement in 2024 and an $8.9 billion offer to resolve ongoing claims.

Lucking Coffee

In 2020, the Chinese coffee chain fabricated $310 million in 2019 sales to inflate its financial performance. The fraud led to the company’s delisting from Nasdaq, a stock price collapse, and $180 million in SEC penalties. The company has managed to overcome the scandal, increasing revenue by 87% in 2023, surpassing Starbucks both in number of stores and revenue in China.

Monsanto

In 2015, U.S. agriculture company Monsanto was accused of using glyphosate (an ingredient known to cause cancer, particularly non-Hodgkin lymphoma) in its Roundup herbicide. The scandal led to Bayer — which acquired Monsanto in 2018 — paying over $10 billion to settle tens of thousands of lawsuits.

Olympus

In 2011, Olympus, a global medical technology company, was accused of concealing $1.7 billion in investment losses through fraudulent accounting practices. Olympus eventually admitted to the fraud, resulting in arrests, lawsuits, and a near 80% drop in its market value.

Petrobras

In 2014, it was revealed that Brazil’s state-owned oil giant Petrobras had accepted bribes from construction firms in exchange for inflated contracts. This led to significant financial losses for Petrobras, estimated at nearly $17 billion.

Standard Chartered

Between 2001 and 2014, Standard Chartered bank was fined over $1.1 billion for violating U.S. sanctions by processing thousands of illegal transactions for Iran and other sanctioned countries.

In the table above, you can see the historically highest and lowest stock prices of all the publicly traded companies included in this part of our research.

For the majority of them (28 out of 33) their lowest stock prices occurred as a direct result of the scandal they were involved in. The rest either had their lowest stock price before the scandal (like Apple, Amazon, and Yahoo) or several years after (like Standard Chartered and Deutsche Bank), which suggests the drop was not related to the scandal itself.

Interestingly, some of these companies — such as Johnson & Johnson, Herbalife, and Monsanto — reached their highest stock price some time after the scandal broke out, suggesting that they managed to fully overcome the setback.

Who Thrived? Scandals That Didn’t Hurt Business

Interestingly, some companies faced no significant repercussions for the scandals they were involved in.

PayPal – Honey

A YouTube investigation by MegaLag brought to light a scam involving Honey, a browser extension owned by PayPal that automatically applies online coupons on e-stores. The YouTuber alleged that Honey overrides affiliate links during checkout, crediting itself for sales it did not generate, while providing minimal cashback to users. It also withholds better discounts in favor of deals from partnered retailers.

This has sparked class-action lawsuits and backlash from influencers and users, but PayPal has yet to suffer any significant consequences. Its stock price in December of 2024 was approximately $88.51 — hardly a significant fall from the $90.02 it had right before the scam was revealed.

Google AdSense

In May 2014, Google was accused of unfairly banning AdSense publishers to avoid paying their earned revenues. As a result, Google faced lawsuits and criticism from affected publishers. However, AdSense remained a significant revenue driver, contributing to Google’s continued growth, generating $264 billion for the company in 2023 alone.

JPMorgan Chase

In 2012, a trader in the JPMorgan Chase’s London office made massive, risky bets on derivatives that led to $6.2 billion in losses. Poor risk management and attempts to hide the losses worsened the situation. The bank admitted fault and paid over $1 billion in fines to regulators. Despite this, it earned a record profit of $21.3 billion that same year.

Conclusion

While some companies, like Enron and Adelphia, collapsed under the weight of their scandals, others, such as Volkswagen and BP, faced huge fines but managed to recover. Despite these scandals, some businesses have continued to thrive after paying penalties and changing their ways.

Ultimately, these scandals serve as reminders of the importance of transparency, accountability, and ethical leadership in business. They underscore that while some may profit in the short term, the long-term costs of dishonesty often outweigh any gains.

React to this headline: